Chemical logistics is on the move - scenarios and outlook for Germany

The chemical industry is a key industry in Germany. It’s one of the largest sectors of the country’s economy and accounts for a major proportion of its exports. However, it’s also one of the sectors with very high energy requirements. Companies began developing strategies to replace fossil fuels even before the energy transition became necessary. However, Russia’s war of aggression against Ukraine and the resulting loss of gas as a “bridge” energy source has increased the pressure to find alternatives that would make the German chemical industry sustainable. A study entitled “Chemical logistics on the move: Scenarios and outlook for Germany,” which was supported by DACHSER Chem Logistics, examines the impact of this development on the demand for chemical logistics.

The study describes the status quo in chemical logistics regarding the flow of goods, develops concrete scenarios for the various developments, and outlines the expected effects on the future organization of logistics flows in Germany. Based on these findings, the study team drew up six recommendations for action as to how chemical logistics can help ensure Germany’s continued success in international competition as a chemical industry location.

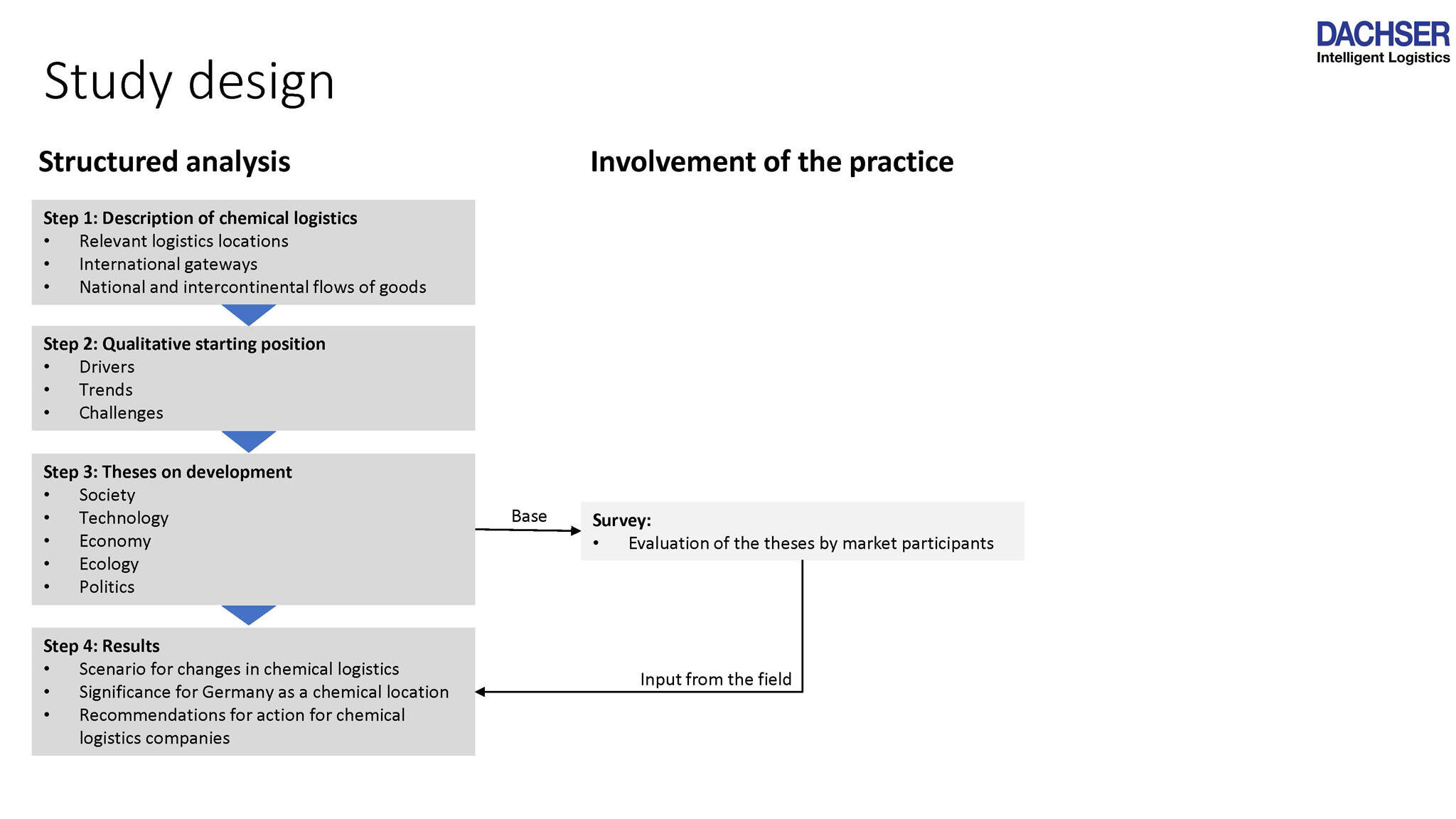

The work was carried out in several steps in order to develop the results in as nuanced and analytical a way as necessary, while at the same time keeping them as practical and plausible as possible (see figure).

Analysis of the chemical industry in Germany

First, the study summarizes the current state of the chemical industry. With knowledge of the sector’s production and logistics locations as well as of the flow of goods, it’s possible to show the expected changes in concrete terms.

Revenue of around EUR 200 billion, almost 4,000 companies, over 350,000 employees, and logistics costs of some EUR 10 billion: the chemical industry is a key sector of the German economy. It operates production sites throughout the country and is an important supplier to every industry. Its logistics locations are concentrated in the west of Germany (the states of North Rhine-Westphalia and the “chemical triangle” of Baden-Württemberg, Rhineland-Palatinate, and Hesse). The most important transport corridor for bulk products and bulk cargo stretches from the southeast to the northwest of the country and the ARA seaports. Packaged goods are distributed more broadly and don’t have a similarly clear-cut corridor.

Next, the study looked at overarching trends and drivers that are relevant for the economy in general and the chemical industry in particular. These offer the opportunity to assess the different directions of development. Because the chemical industry accounts for such a large share of imports and exports, global changes are of particular importance. The current geopolitical upheavals and changes have led not only to high energy costs, but also to increasing protectionism in major partner countries. Upcoming political decisions (elections) in many relevant countries present another challenge, as these could significantly change the situation. This uncertainty on the macroeconomic side, especially the resulting high energy costs and the current weakness of the German economy as a whole, doesn’t make it easy to reach decisions about necessary investments in digitalization, new logistics solutions, and climate protection.

The study “Chemical logistics is on the move” was conducted by Prof. Dr. Christian Kille, Professor of Retail Logistics and Operations Management at the Technical University of Würzburg-Schweinfurt and Dr. Andreas Backhaus and supported by DACHSER Chem Logistics.

Development of a realistic scenario

Following this analysis, the team drew up 13 theses regarding the impact of trends and drivers on the chemical industry and chemical logistics. These in turn served as input for a survey of the specialist public in collaboration with CHEManager. The theses helped to keep the complexity manageable and make further interpretations more practical. Steps were taken to distinguish the effects of social, technological, economic, ecological, and political changes.

Based on these findings, the study team developed a realistic scenario that they then analyzed to see how it will tend to change the chemical industry and chemical logistics in particular. Here are the results of the scenario analysis:

- Social: Despite intensive efforts to improve their reputation in society, companies in the chemical industry and in chemical logistics aren’t managing to position themselves sufficiently as attractive employers. As a result, they will not only feel the effects of the general lack of qualified personnel, but will also face greater challenges in their transformation.

- Technological: Infrastructure challenges are on the rise. However, increased investment plus sophisticated digitalization and automation solutions offer public institutions as well as companies in the chemical industry and chemical logistics ways to increase their efficiency and thus their competitiveness.

- Economic: Numerous chemical companies will continue to report falling revenue and closures of production sites, while others will experience growth. The expected developments will be challenging for chemical logistics companies that focus on bulk products. In contrast, volumes of packaged goods and related additional services will grow.

- Ecological: The climate-related influences on the chemical industry in general are manageable, even if they are accompanied by cost increases. Nevertheless, the chemical industry and chemical logistics will undergo a reorganization in the long term, as not all companies will succeed in the transformation.

- Political: On the path toward resolving the (trade) conflicts, reducing today’s high energy costs, and achieving climate neutrality, there are many obstacles on the political front. While this burden will be manageable for some companies, for others it will lead to unacceptable cost increases.

Analysis and recommendations for action

Overall, this scenario means that some logistics locations, particularly in the south and west of Germany, should expect negative developments. Locations in the east and north will tend to have better access to renewable energy and therefore face fewer challenges. The locations with specialty chemicals will probably find it somewhat easier to handle the changes. This not only shifts the focus of logistics locations to the east, but also alters the flow of goods.

Against this backdrop, the study team has derived recommendations for designing chemical logistics so that chemical companies can continue to compete successfully on an international level despite the challenges.

Logistics can (still) be successful only through people: Investing in the recruitment and retention of personnel secures the existing business and promises long-term competitive advantages.

Innovations mean advantages for locations: In addition to participating in research into logistics innovations, measures to modernize logistics are needed to ensure a good position in international competition.

Germany as a location for the chemical industry can succeed only with high-quality, diversified portfolios: Investments in automation and digitalization are crucial in logistics in order to increase the resilience and thus the performance of the chemical industry.

A transformation will take place in the chemical business: Changes in the market for chemicals require the reassessment and adaptation of logistics networks and services.

The effects of climate change and the energy transition are leading to changes of strategic direction in the chemical industry: Logistics must prepare for restrictive measures in the course of the energy transition and implement processes that are resistant to weather influences.

Chemical companies have to find their way in a multilateral world with increasing tensions: The trend toward regionalization is driving a reduction in overseas exports due to growing competition. The remaining global supply chains must be operated more robustly with comprehensive cooperation, new approaches, and modern technologies.

In sum, world-leading chemical logistics is a central pillar for a successful chemical industry in Germany.