When everything that belongs together, comes together

The world is changing. And as a result, so are the markets. Shifts in geopolitical power and interests, combined with supply chains under almost constant strain, highlight the need for new transport and logistics concepts—ones that are designed to run seamlessly from door to door while also closely integrating carriers and IT systems. Logistics provider DACHSER is rising to the challenge, focusing over the medium and long term on the dynamic growth in Asia and the Americas.

A report by Michael Kriegel, Department Head DACHSER Chem Logistics

Today’s global supply chains are under a level of stress they haven’t seen for a long time, what with crises, wars, and geopolitical factors. How and to what extent trade needs to recalibrate to this new reality is a matter of debate among economists. Some talk about decoupling, some about deglobalization, and some are expecting increased diversification and new forms of cooperation between systems and markets.

The fact is, different markets around the world are currently moving at very different speeds. While in 2008, the US and Europe were evenly matched in economic output, the US figure is now 80 percent higher. In the future, global growth will continue to occur mainly outside of Europe. According to estimates by the International Monetary Fund, the contribution of Asia Pacific countries (APAC) to global gross domestic product is set to rise to over 40 percent by 2040—and will be over half by 2050. APAC already represents about two-thirds of the global chemical market. The biggest and most dynamic chemical market by far—home to over half the world’s production of chemicals—is and will remain China. Although the country’s economy is currently going through a rough patch, in the long term, demand there for chemical products will rise much more sharply than in Europe or the Americas. Companies need to ready themselves for this change.

Uptick in German chemical industry exports

There are some glimmers of light on the horizon. Since the start of the year, Germany’s chemical exports in particular have picked up pace. Production rose 3 percent on an exceedingly weak prior year. Business grew especially with customers outside of Europe, due to a rise in demand in those countries and empty warehouses in customer industries, which led to increased numbers of incoming orders. According to a statement by the German Chemical Industry Association (Verband der Chemischen Industrie e.V., or VCI), international revenue in the first quarter of 2024 was up 3.6 percent on the previous quarter. Still, production and revenue figures in the chemical industry overall are a good 11 percent lower than they were before the crisis. At the moment, things are moving in a positive direction; however, it will be some time before improvements offset the losses of the previous year.

The weak point remains Germany as a location for the chemical industry. Major chemical companies there report that, in addition to a lack of orders, their main concerns are energy prices and bureaucracy. A recent VCI survey reveals that over 70 percent of these businesses believe themselves to be massively hampered by regulatory requirements, with increasing red tape a particular challenge.

Key momentum is coming from the markets outside Germany, and the country’s chemical industry expects exports to increase over the coming months. With many international markets experiencing economic recovery, demand for chemical products that are “made in Germany” is likely to rise.

Christian Kille, Professor of Retail Logistics and Operations Management at the Technical University of Applied Sciences Würzburg-Schweinfurt, is working with Dr. Andreas Backhaus on a study in which they analyze the effects of global changes on Germany as a logistics location and on companies’ logistics decisions. The two experts’ study will be published in October 2024 and is sponsored by DACHSER Chem Logistics.

The best of both worlds

Although the mood in Germany in particular is still reserved, growing markets in other parts of the world are cause for confidence. The major growth drivers of the global economy right now are APAC and North America. For DACHSER as a logistics provider, this calls for stepping up the integration of international transports with its high-performance European overland transport, ultimately to create a seamless, door-to-door global groupage solution over the coming years. The focus here is on combining a great many individual solutions to form a holistic and consistent overall solution from Europe to the world and from the world to Europe. In the future, two worlds will be united—the European groupage business and the air and sea freight business. Our goal is to build up just such a global groupage network. This kind of sweeping network integration is challenging and cannot be accomplished overnight. But we’ve paved the way.

Key momentum is coming from the markets outside Germany, and the country’s chemical industry expects exports to increase over the coming months. With many international markets experiencing economic recovery, demand for chemical products that are “made in Germany” is likely to rise.

The backbone of this comprehensive integration across the entire market for logistics and for air and sea freight is provided by DACHSER’s overland transport groupage network. With its high degree of standardization and integration, it serves as the basis for organic, value-driven growth. Our most recent strategic acquisitions bring these efforts a step farther as well. Even at a time when the company’s revenue and that of its competitors has taken a serious hit, DACHSER has made sustainable long-term investments in its network. For instance, it has acquired 80 percent of longtime partner FERCAM’s groupage and contract logistics business in Italy. Following Graveleau in France and Azkar in Spain, this is the third biggest acquisition in DACHSER history. The DACHSER & Fercam Italia joint venture started operations on April 1, 2024. Three more transactions in 2023 expanded the air and sea freight network overseas: The acquisition of ACA International, headquartered in Melbourne, brought Australia and New Zealand into DACHSER’s air and sea freight business. A joint venture with Nishi-Nippon in Japan came next. And finally, in South Africa, DACHSER took over the remaining 30 percent of shares of its joint venture there, which was created in 2011.

Strengthening digital networks

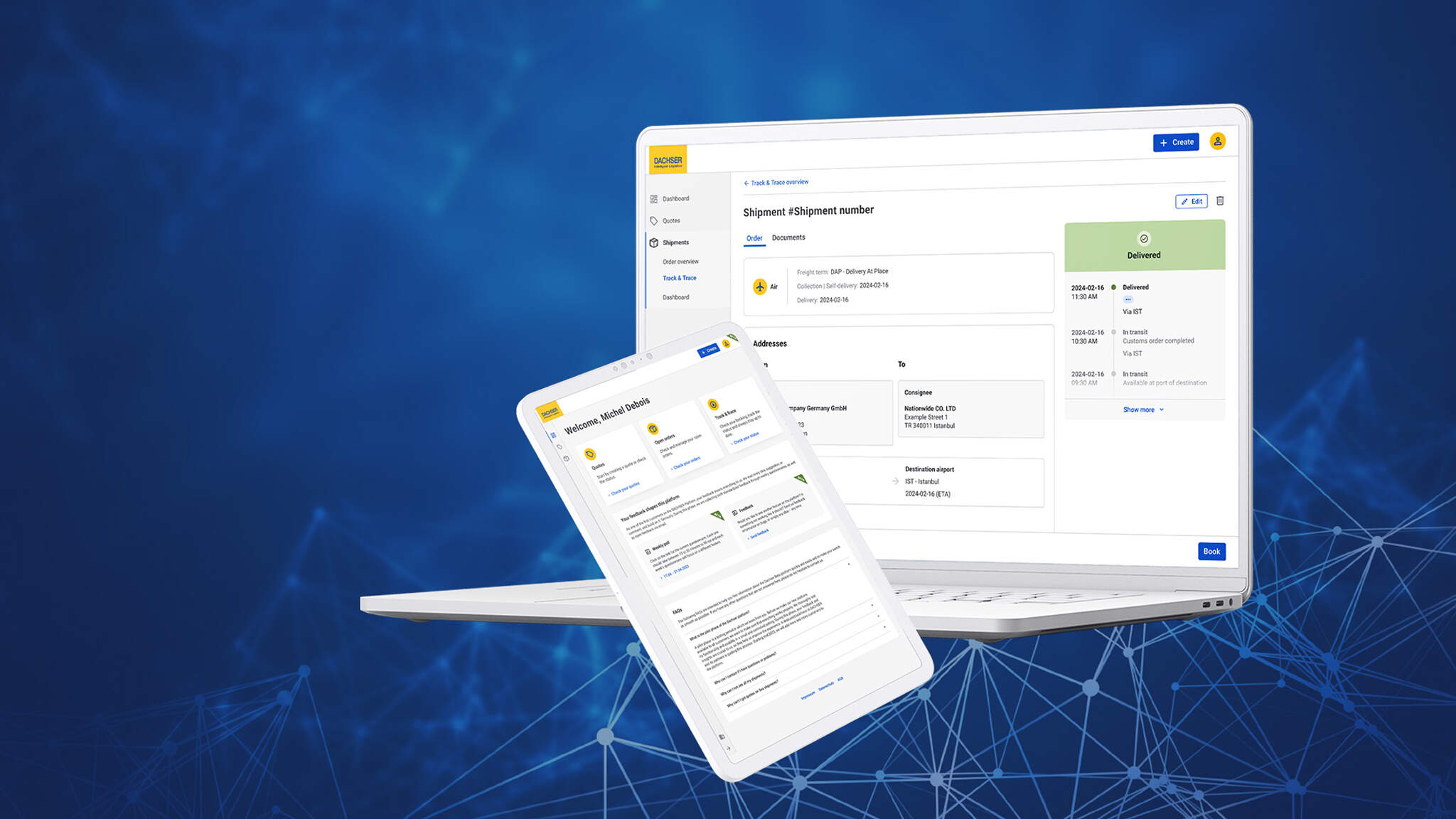

This kind of corporate growth requires that the cyber-socio-physical network—consisting of assets, people, information, and technologies—grow as well. To offer an integrated digital platform for all logistics requirements, DACHSER enlisted the participation of its customers to create DACHSER platform: a solution that integrates all services across all carriers and presents them in a user-oriented way, giving clients and customers an overview of their orders and shipments, regardless of carrier.

This customer platform digitally combines the services of the Road Logistics and Air & Sea Logistics business fields across the board. Bookings and shipment documents are managed there, and the end-to-end tracking and tracing system shows shipments along all transport routes in real time. Price inquiries from registered customers for multiple transport routes can be displayed and alternatives selected. At present, several hundred companies are using DACHSER platform to manage their air and sea freight transports. By the end of the year, it will be available to all of DACHSER’s air and sea freight customers, and in summer 2024, DACHSER will begin gradually adding overland transport to the platform, too. In logistics, the course has been set for integration—in both the physical and digital worlds.